Appearance

Invoice Adjustments

Invoice adjustments let you modify an invoice's balance without editing the original line items. Use adjustments for credits, discounts, late fees, write-offs, and interest charges.

When to Use Adjustments

Adjustments are better than editing line items when:

- The original invoice was correct, but circumstances changed

- You need to maintain an audit trail of changes

- The invoice has already been sent to the customer

- Accounting needs to track adjustments separately

Adjustment Types

| Type | Effect | Common Uses |

|---|---|---|

| Credit | Reduces balance | Goodwill credit, price adjustment, returned product |

| Discount | Reduces balance | Loyalty discount, settlement discount, promotional pricing |

| Write-off | Reduces balance | Uncollectable debt, small balance clearance |

| Late Fee | Increases balance | Overdue payment penalty |

| Interest | Increases balance | Ongoing interest on overdue balance |

| Other | Either direction | Miscellaneous adjustments |

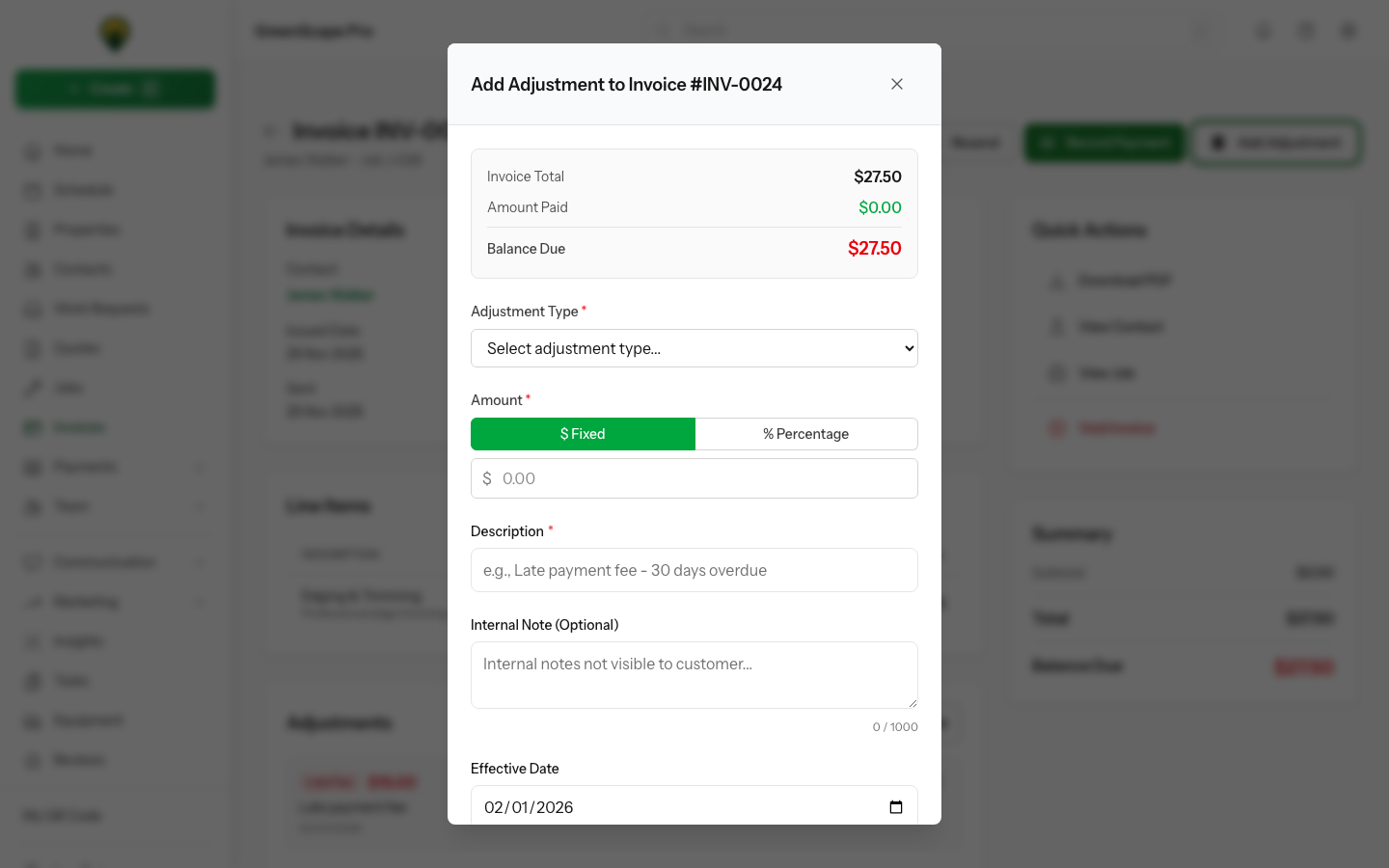

Adding an Adjustment

- Open the invoice you want to adjust

- Click More → Add Adjustment

- Select the adjustment type

- Enter the amount

- Add a description (visible to customer)

- Optionally add an internal note (staff only)

- Click Save

The invoice total updates immediately.

Click to enlarge

Amount Rules

Adjustments automatically enforce the correct sign:

- Credits, discounts, write-offs — Amount must be negative (reduces balance)

- Late fees, interest — Amount must be positive (increases balance)

- Other — You choose the sign

Amount Limits

Credits and discounts cannot exceed the remaining balance. If an invoice has $100 remaining, you cannot add a -$150 credit.

Which Invoices Can Be Adjusted

Adjustments can only be added to invoices with these statuses:

| Status | Can Adjust? |

|---|---|

| Draft | No — edit line items instead |

| Sent | Yes |

| Viewed | Yes (treated as Sent) |

| Overdue | Yes |

| Partially Paid | Yes |

| Paid | No — balance is already zero |

| Void | No — invoice is cancelled |

Viewing Adjustments

Adjustments appear on the invoice in the Adjustments section:

- Description — What you entered (customer sees this)

- Amount — The adjustment value

- Date — Effective date of adjustment

- Added by — Staff member who created it

In Activity Log, you can see the full history including internal notes.

Deleting Adjustments

You can delete an adjustment only if:

- No payments have been received on the invoice

- You have admin or owner permissions

After any payment is received, adjustments are locked to maintain accounting integrity. If you need to undo an adjustment on a partially paid invoice, add a reverse adjustment instead.

To Delete

- Open the invoice

- Find the adjustment in the Adjustments section

- Click the Delete icon

- Confirm deletion

The invoice balance recalculates automatically.

Write-offs

Use write-offs to clear small or uncollectable balances:

- Add an adjustment with type Write-off

- Set amount to the negative of the remaining balance

- Add description like "Written off - uncollectable"

- Add internal note with reason (for your records)

When a write-off clears the entire balance, the invoice status changes to Paid.

Late Fees

To add a late fee:

- Open the overdue invoice

- Add adjustment with type Late Fee

- Enter the fee amount (positive number)

- Add description like "Late payment fee - 30 days overdue"

Accounting Integration

When synced to Xero or your accounting system:

- Credits/discounts appear as separate line items or credit notes

- Late fees/interest appear as additional charges

- Write-offs may sync to a bad debt expense account

Check your Xero integration settings to configure how adjustments are handled.

Customer Visibility

| What Customer Sees | What Customer Doesn't See |

|---|---|

| Adjustment description | Internal notes |

| Amount | Who added it |

| Effective date | Timestamps |

Keep descriptions professional — customers see them on invoices and payment pages.

Common Workflows

Settling for Less

Customer offers to pay $900 on a $1,000 invoice:

- Add Discount adjustment: -$100

- Description: "Settlement discount"

- Accept the $900 payment

Small Balance Clearance

Invoice has $0.23 remaining due to rounding:

- Add Write-off adjustment: -$0.23

- Description: "Balance cleared"

- Invoice marks as Paid

Adding Overdue Penalty

Invoice is 60 days overdue:

- Add Late Fee adjustment: $50

- Description: "Late payment fee - 60 days"

- New balance includes the fee

Permissions

| Role | Add Adjustment | Delete Adjustment | View |

|---|---|---|---|

| Owner | Yes | Yes | Yes |

| Admin | Yes | Yes | Yes |

| Office | Yes | No | Yes |

| Field | No | No | No |